Capital is rushing into the Brazilian market.

As the leading economy in Latin America, Brazil saw a surge in foreign direct investment to $91 billion in 2022, marking a nearly 98% increase compared to 2021 and reaching a new high in almost a decade.

According to data released by the Brazilian Institute of Geography and Statistics (IBGE), Brazil's GDP grew by a robust 0.9% in the second quarter, three times the market's expected 0.3%, and surpassing China's 0.8%. This positions Brazil as the seventh-ranked economy globally in terms of quarter-on-quarter growth.

Simultaneously, the consumer confidence index has experienced continuous growth for four consecutive months, reaching 96.8 in August, the highest level since February 2014. This reflects, to some extent, consumers' optimism about the current economic situation.

Admittedly, Brazil's economy, thriving with vitality beyond imagination, is unfolding over 18,800 kilometers away from us.

Brazil: A Market of Abundant Opportunities As a member of the G20 and BRICS, Brazil boasts political stability and a relatively well-established legal system, making it China's largest trading partner in Latin America. In recent years, the Brazilian government has been vigorously developing the digital economy, with some cities already deploying 5G network services.

This trend of digitization and electronicization is gradually permeating the daily lives of Brazilians, providing fertile ground for domestic internet companies to go global. Currently, popular tracks for domestic companies entering the Brazilian market include gaming, e-commerce, finance, tools, and transportation.

The gaming market in Brazil is experiencing a rapid boom, especially in the mobile sector. As of 2022, Brazil had 68.4 million mobile game players, with a penetration rate of 31.7%. It is expected that the number of mobile game players in Brazil will continue to grow over the next five years.

Differing from other regions, Brazilian mobile gamers exhibit a noticeable trend of being younger and having a higher proportion of females. According to the "2023 H1 Domestic Mobile Games Overseas White Paper," users aged 18-34 in Brazil constitute nearly 60% of mobile gamers, with a female ratio of 52%. In the first half of the year, the top-earning mobile games in the market were primarily elimination games, accounting for about 20%, followed by simulation, shooting, and strategy games.

Brazil Mobile Games Revenue Distribution (Jan-Jun 2023)

*Data Source: Sensor Tower, Nativex*

Brazil has approximately 114.7 million e-commerce consumers, with an annual consumption of around $40 billion. The per capita consumption of e-commerce goods is approximately $349, making it one of the fastest-growing markets in terms of app usage. According to Nativex estimates, Brazil's retail e-commerce sales growth rate in 2025 will rank first globally.

Global Retail E-commerce Sales Growth Rate CAGR (2022-2025 Forecast)

*Data Source: Statista 2022*

Among all e-commerce categories, the market share of electronic products is the largest, accounting for about 27.9% of total e-commerce revenue, followed by "Food and Personal Care," "Furniture and Appliances," "Fashion," and "Toys, Hobbies, and DIY."

Driven by Brazil's national digital transformation strategy, the financial industry has become one of the most penetrated sectors in Brazil's digital economy. The "2023 Brazil Fintech Report" shows that the penetration rate of financial services in Brazil has reached around 84%, with digital payments, online lending, digital banking, and internet insurance being popular business models.

Business Challenges in Expanding to Brazil Despite the tempting prospects of the Brazilian market, it is not a piece of cake that anyone can easily take a bite out of. Companies entering this market will face a business environment significantly different from that in their home country, particularly in terms of regulations, culture, and taxation.

Brazil is a federal state with a separation of powers into executive, legislative, and judicial branches. However, it also places importance on personal relationships. This means that any action must take into account various factors, such as social reactions, political impacts, economic interests, and opinions of financial groups, which can be challenging for newcomers.

Influenced by Western culture, Brazilian culture exhibits significant differences from Eastern cultures. Brazilians largely trust religion, primarily Catholicism. They also have different perceptions of colors, associating brown with misfortune, purple with sadness, and yellow with despair. Additionally, the "OK" hand gesture should be avoided in Brazil.

Brazil has a complex tax system, comprising federal, state, and municipal taxes, totaling up to 58 kinds. After more than 30 years of discussion, the federal government recently approved a tax reform plan. For instance, it plans to consolidate five indirect taxes—IPI, ICMS, ISS, PIS, and COFINS—into a single IVA tax, while introducing CBS and IBS. However, the complete implementation is expected to take around 10 years, during which there may be a period of confusion with both tax systems running in parallel.

CPaaS Facilitates Business Expansion into Brazil At the right time and through channels frequented by the target audience, reaching users with information they find interesting should be the correct approach for all marketing activities.

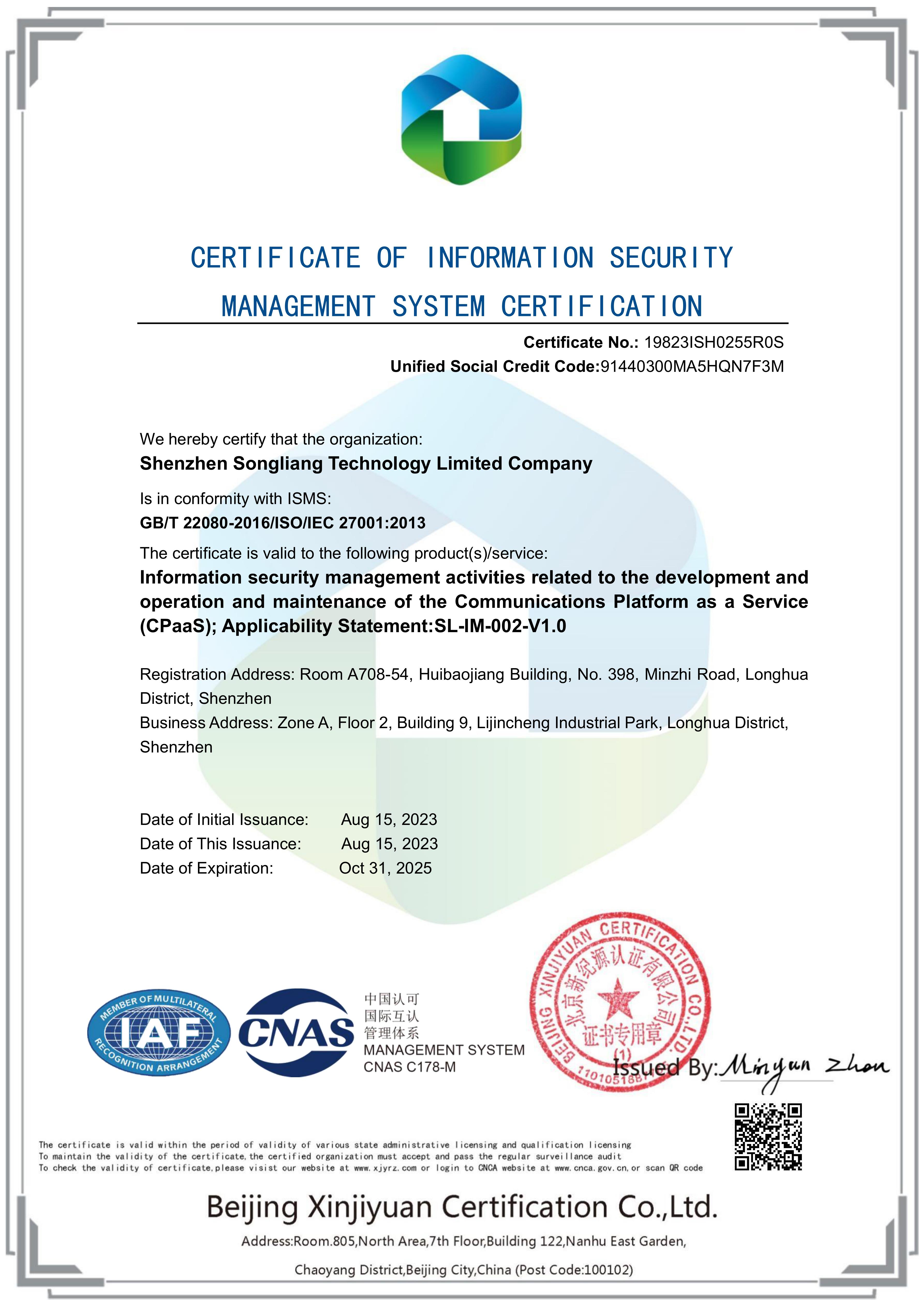

Before formally entering an unfamiliar market, choosing an international cloud communication CPaaS (Communications Platform as a Service) provider well-versed in local policies and regulations can often make your efforts more effective. CPaaS allows enterprises to flexibly choose international communication channels that match their business needs and development stages and adjust or add them at any time.

Through channels such as SMS, social media, and email, interactions between businesses and customers become more convenient and efficient in communication scenarios such as user verification, marketing, and notifications. Especially in Brazil, a country with high communication and internet penetration rates, this approach is particularly effective. Currently, Brazil has four major telecom operators: Oi, Vivo, Claro, and TIM, with Vivo being the largest mobile network operator, holding a 32% market share.

Brazil Telecom Operator Market Share

*Data Source: Statista. Country Report, 2021*

It's important to note that Brazil spans three time zones, and marketing content is not allowed to be sent outside the hours of 9 AM to 9 PM. Additionally, content or services related to policy, adult content, alcohol, gambling, etc., may face restrictions in Brazil.

Moreover, depending on the region where users are located, there are significant differences in the preferred instant messaging tools. Data indicates that in Latin American countries such as Brazil and South Africa, WhatsApp has a high penetration rate among internet users aged 16-64. If you want to engage, serve, and precisely reach these target customer groups, WhatsApp is an indispensable channel.

If you're interested in learning more about strategies for entering the Brazilian market, feel free to contact ITNIO TECH.

Capital is rushing into the Brazilian market.

Capital is rushing into the Brazilian market.